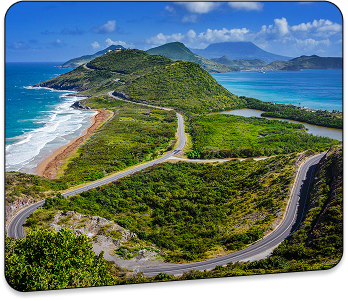

The beautiful island of Nevis is known as a hideaway of the rich and famous, for good reason. A Nevis (Tax) Exempt Trust is your ultimate, behind-the-scenes inter-generational planning tool. The LLC is your public interface with the global financial system: an all-access pass to top international private banks that might not be available in your home country.

Challengers face a $100K bond, a local lawyer, high proof standards, and 1 year to act.

Trusts and LLCs remain confidential: no public beneficial ownership register.

Open accounts in top money-center banks, or access worldwide funds, brokerage and crypto accounts.

Nevis imposes no capital gains, withholding, or corporate taxes on offshore income.

Your wealth remains protected while you maintain control over your financial future. A Trust Deed means you write the rules with the help of a qualified trust lawyer.

You write the rules for distributions, maintaining control even after your death.

An optional extra to shield your wealth from arbitrary court decisions.

Automatically change jurisdiction if the trust is attacked in a local court. Or leave greedy creditors with a tax liability but no assets.

Hold precious metals, stock certificates, real estate, crypto, or any asset worldwide in your offshore trust!

With a few online meetings and KYC documents, you can establish a secure trust and LLC structure while ensuring full compliance with Nevis regulations and international best practices. There’s no need to visit Nevis in person, although if you do, you might decide never to leave!

Step 1

Free ConsultationDiscuss your needs and goals with our experts to determine if this is the right structure for you.

Step 2

Fee QuotationYou’ll get a clear written proposal with all fees, what’s included (and not), and a list of documents we’ll need. If you agree, and digitally sign and return it to us, we’ll send the first invoice to get started.

Step 3

OnboardingFor your protection and to comply with international regulatory norms, we need to verify that you are who you say you are and where your money comes from. Some people are surprised that doing business offshore requires more documents than in their home country—but remember: your life is an open book there, not offshore. Don’t worry; we will guide you through the process and make it as painless as possible.

Step 4

Trust Deed PreparationWe will consult with you online to draft and personalize your trust deed. Once you sign it, it takes immediate legal effect.

Step 5

Trust and LLC RegistrationYour trust and LLC must be registered with the government of Nevis. Don’t worry, the government will not receive your personal details. You will receive Certificates of Registration for both the Trust and LLC. This step takes 2-3 working days.

Step 6

Account Opening (optional)Bring your structure to life by opening one or more accounts in international banks and platforms. We’ll guide you through the process, which can take time due to banking procedures—but we’ll make it smooth and the end results are rewarding. Choose from our network of recommended banks, brokerages, EMIs, neobanks, or even self-custody wallets.

-

Verify Your ID: Certified/notarized copies of your Passport plus one other document (ID card, driver’s license, etc.). Also, verify the IDs of beneficiaries, protectors, etc.

-

Verify your residential address: Usually with a copy of a utility bill.

-

Verify your source of wealth: This applies to your general financial situation. Examples might include a personal balance sheet, copies of tax returns, salary slips or confirmation letters, proof of dividends, inheritance, real estate sale, etc.

-

Verify source of funds: For example, a bank statement, crypto wallet address etc showing the specific funds you are going to put into the trust.

-

References: commercial, professional, and banking references (we can supply templates).

-

Affidavit of compliance: we will supply a draft.

-

Other documents may be requested, depending on circumstances.

Clarify the list of required documents, learn about all the nuances of the process, timelines, and costs from the professionals of the portal.

Uliana Siva

Consultant for company registration, bank account opening, residency, and citizenship.

years of experience

successful cases

We value every client, cherish our reputation and strive for long-term co-operation. Our clients are business people, investors, expats, digital nomads and others. We pride ourselves on the fact that our service meets high standards.

Years of experience

Clients worldwide

Successful projects

Cases

We don’t offer one-size-fits-all templates — only tailored solutions where every detail is carefully designed to meet your specific needs, business interests, and long-term goals.

For over 15 years, we’ve been crafting effective strategies for international businesses and providing comprehensive support.

We agree on the project costs upfront — you will not experience any hidden fees or unexpected charges.

We make sure that you are in capable, trustworthy hands. We fully comply with legal requirements and deliver on every agreed-upon objective.

Your privacy is our top priority. We never share documents, information, or personal data with third parties.

We offer experience, not promises. Our track record of successful case studies and thousands of satisfied clients demonstrates our competence and trustworthiness.

We value the trust of our clients.

Feedback is the best confirmation of the quality of our services and professionalism. This is confirmed by the reviews on Trustpilot.

Google

Google4.86 (21 Reviews)

Trustpilot

Trustpilot4.80 (71 Reviews)

FAQ about Nevis Offshore Trust and LLC

Our Offers

Your Business

We provide services to private individuals, HNWIs, and companies.

.png)

+1 888 650 0020

+1 888 650 0020

info@internationalwealth.info

info@internationalwealth.info

PH Park Studios, C. La Colina, Panama

PH Park Studios, C. La Colina, Panama